Can I Buy a House Making $20 an Hour?

If you like many Americans who dream of owning a home, you might wonder if it’s possible with an hourly wage of $20. The answer is yes, but it might require careful planning and some financial sacrifices. This comprehensive guide will delve into the complexities of buying a house with a $20-an-hour income, discussing affordability, financing options, and tips to help you achieve your dream of homeownership.

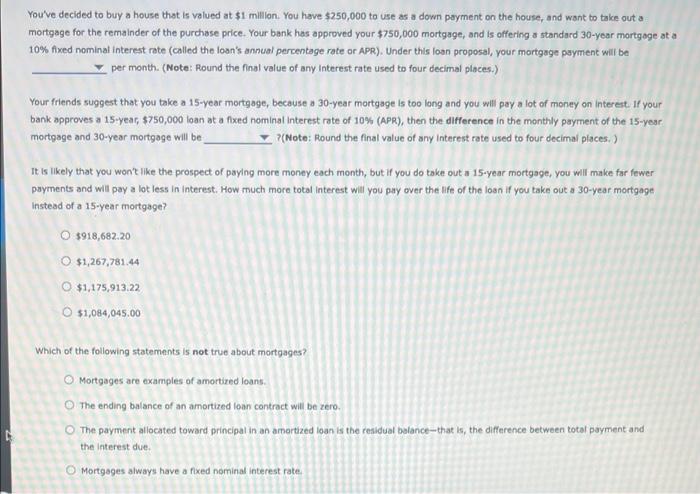

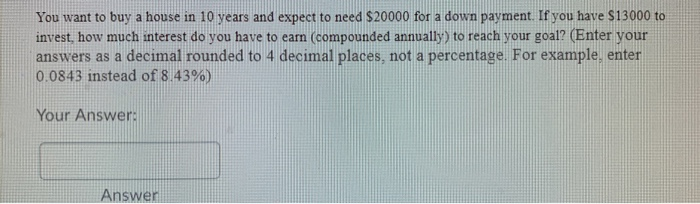

The journey to homeownership begins with assessing affordability. Earning $20 per hour equates to an annual salary of approximately $41,600 before taxes. Lenders typically recommend allocating no more than 28% of your monthly gross income towards housing expenses, including mortgage payments, property taxes, and insurance. Based on this guideline, you can afford a monthly mortgage payment of around $925.

Understanding Mortgage Options

Securing financing is a crucial step in the homebuying process. Several mortgage options are available to borrowers with varying credit scores and financial circumstances.

Conventional loans are a popular choice, requiring a down payment of at least 20% and a FICO score of 620 or higher. If you don’t have a substantial down payment, you may consider an FHA loan, which allows for a 3.5% down payment but has stricter credit score requirements. VA loans are available to eligible veterans and active-duty military members, offering competitive interest rates and no down payment.

Tips for Achieving Homeownership

Buying a house with a $20-an-hour income requires smart financial planning and a willingness to make some sacrifices. Here are some expert tips to guide you:

Improve Your Credit Score: A higher credit score qualifies you for better interest rates and more favorable loan terms. Pay your bills on time, keep your credit utilization low, and avoid applying for too much new credit.

Increase Your Income: Explore opportunities to supplement your income through overtime, a side hustle, or a part-time job. Additional income can help you save for a down payment and increase your monthly mortgage affordability.

Reduce Your Expenses: Take a close look at your spending habits and identify areas where you can cut back. Reducing unnecessary expenses can free up more money for a down payment or higher mortgage payments.

Consider Down Payment Assistance Programs: Government and non-profit organizations offer down payment assistance programs to eligible homebuyers. These programs can provide grants or low-interest loans to help you cover the down payment.

Frequently Asked Questions

Q: What is the maximum home price I can afford?

A: Based on the 28% rule, you can afford a home priced at approximately $160,000.

Q: How much down payment do I need?

A: The ideal down payment is 20%, but you may qualify for loans with lower down payments depending on your financial situation and credit score.

Q: What are the closing costs associated with buying a house?

A: Closing costs typically range from 2% to 5% of the home’s purchase price and include fees for title insurance, lender fees, and property taxes.

Conclusion

Buying a house on a $20-an-hour income is possible with careful planning and financial discipline. By assessing your affordability, exploring financing options, and following expert tips, you can increase your chances of achieving your dream of homeownership. Remember to do thorough research, consult with a mortgage lender, and make informed decisions throughout the process. Your dedication and perseverance will ultimately lead you to the fulfillment of owning your own home.

Are you interested in learning more about buying a house on a budget? Share your questions or comments below, and I’d be happy to provide additional insights.

Image: www.chegg.com

Image: www.flickr.com

What Do You Need To Buy A House? [Infographic] Real Estate Career, Real … This payment is easy to calculate, because all you need to do is multiply. For example, if your gross (meaning before taxes are taken out) monthly income is $6,000, you would multiply that by 28%